Housing affordability is now Australia's number one community concern.

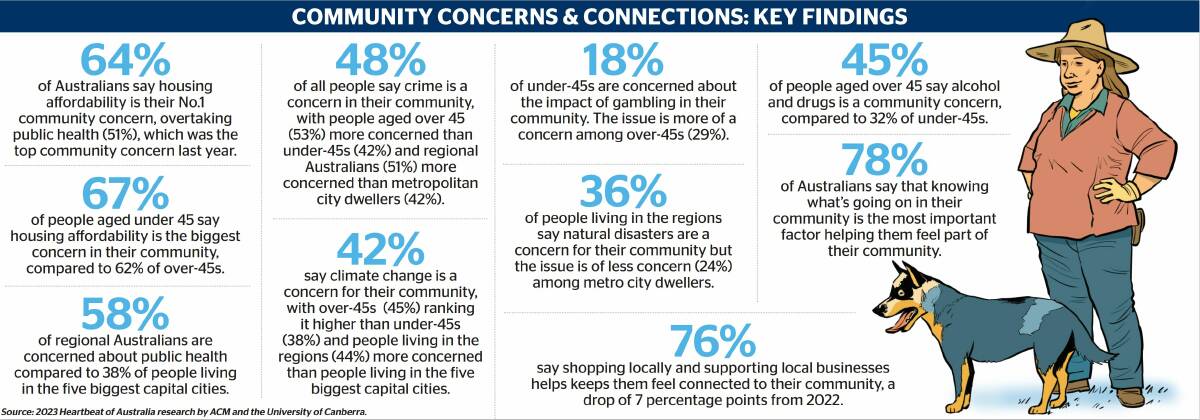

According to new Heartbeat of Australia research released in July by publisher ACM in partnership with the University of Canberra, 64 per cent of the more than 6000 people surveyed nominated housing affordability when asked what issues they were most concerned about in their community in 2023.

The issue is of particular concern to under-45s, with 67 per cent saying it was their main community concern.

It has overtaken public health, which was last year's top concern coming out of the COVID pandemic and which still remains a worry for 51 per cent of people.

First home buyer Hayley Rodd said compromise was crucial when aiming to get into the current housing market.

"That's the reality of it," she said. "Whether you compromise on location, or a house versus a unit or townhouse, it's a compromise. Unless you're in a very good financial situation, you compromise on location, size of the house, or if it's a fixer-upper or ready to go."

Ms Rodd, 34, who works in marketing, and partner Nicholas Morphew, 39, a teacher, bought their first home earlier this year. They opted for a fixer-upper in the more affordable Wollongong suburb of Unanderra.

"If I had my way, we'd probably be living in a non-fixer-upper in (the more expensive suburb of) Balgownie, but for this stage of life, that wasn't where we could be," she said.

They were actively looking to buy a home for four to six months, with a combination of budget restrictions and finding the right location that suited work and lifestyle proving a challenge.

"We wanted to make sure we had a backyard, as we have a dog and my partner loves gardening. The challenge was to find something that fit the bill when it came to budget and area."

Ms Rodd said they hadn't been majorly affected by interest rates since buying; because they purchased a fixer-upper in a less expensive suburb they have a cost-effective mortgage.

"It's still those financial compromises that we're having to make along the renovation journey," she said. "But we are very grateful to be in a position where we can afford our mortgage, and that we have that breathing space that we had got used to with renting, as you have less financial commitments when you're renting."

Ms Rodd said aspiring first home buyers needed to get their financial house in order.

"Look at your finances, create a budget, track your budget, make sure you're ready to compromise or cut down on things if you're wanting to save money," she said.

The Heartbeat of Australia research showed that, after housing affordability and public health, the top community concerns are crime (48 per cent), climate change (42 per cent) and the economic slowdown (41 per cent).

Racism, as "Yes" versus "No" debate intensifies ahead of the expected October referendum on the Indigenous Voice to Parliament, ranked the second-lowest among community concerns (27 per cent), ahead of gambling (23 per cent).

Concerns about housing affordability and the economic slowdown are reflected in Heartbeat's key findings that the cost of living is the top personal issue for 75 per cent of people in 2023.

Asked to measure on a scale of 1-10 what issues they were most concerned about in their personal life, three out of four rated the cost of living at 6 or above - an increase of 21 percentage points since the inaugural Heartbeat study in 2022.

Asked how they felt about their financial situation, 69 per cent said they felt satisfied, down five percentage points from 2022.